Introduction

Walmart and Capital One are on a similar mission to help customers save money and time in their retail and financial lives.

The new Walmart Credit Card rewards our customers for shopping at Walmart, and enables them to save money & time.

Our goals are not only to increase spend, but also to be 1st in wallet & increase digital engagement.

It's time for new rewards card.

My Role

Collaborate with Financial Services Design team to build E2E experience. I was mainly focusing on Cart & Checkout part of experience with three tasks below.

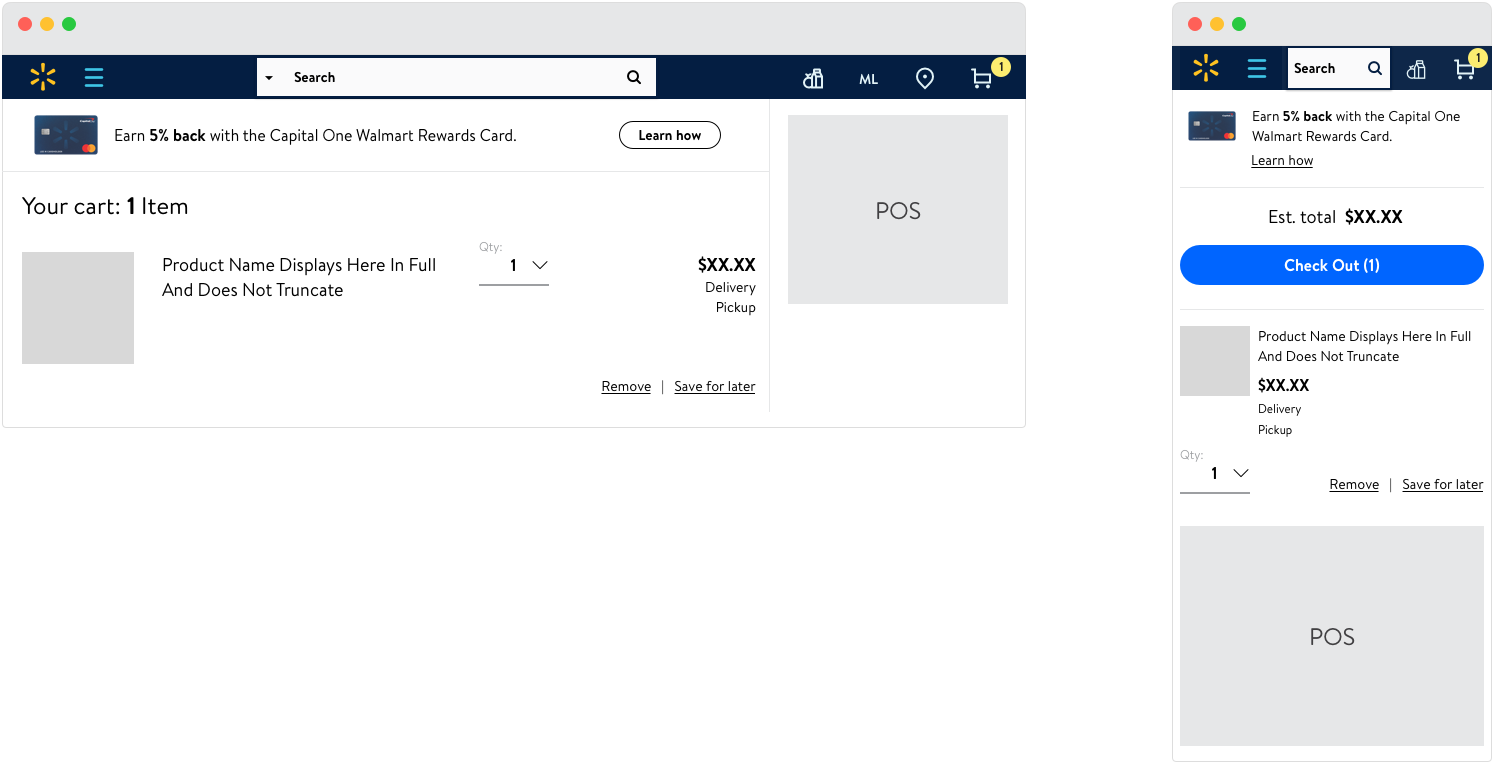

1. Entry point - redesigned new entry point to allow customer easily access Cap One Walmart Rewards Card on Cart page.

2. Pay with point - a new way to redeem customer’s rewards experience by using their points to redeem Walmart.com purchase.

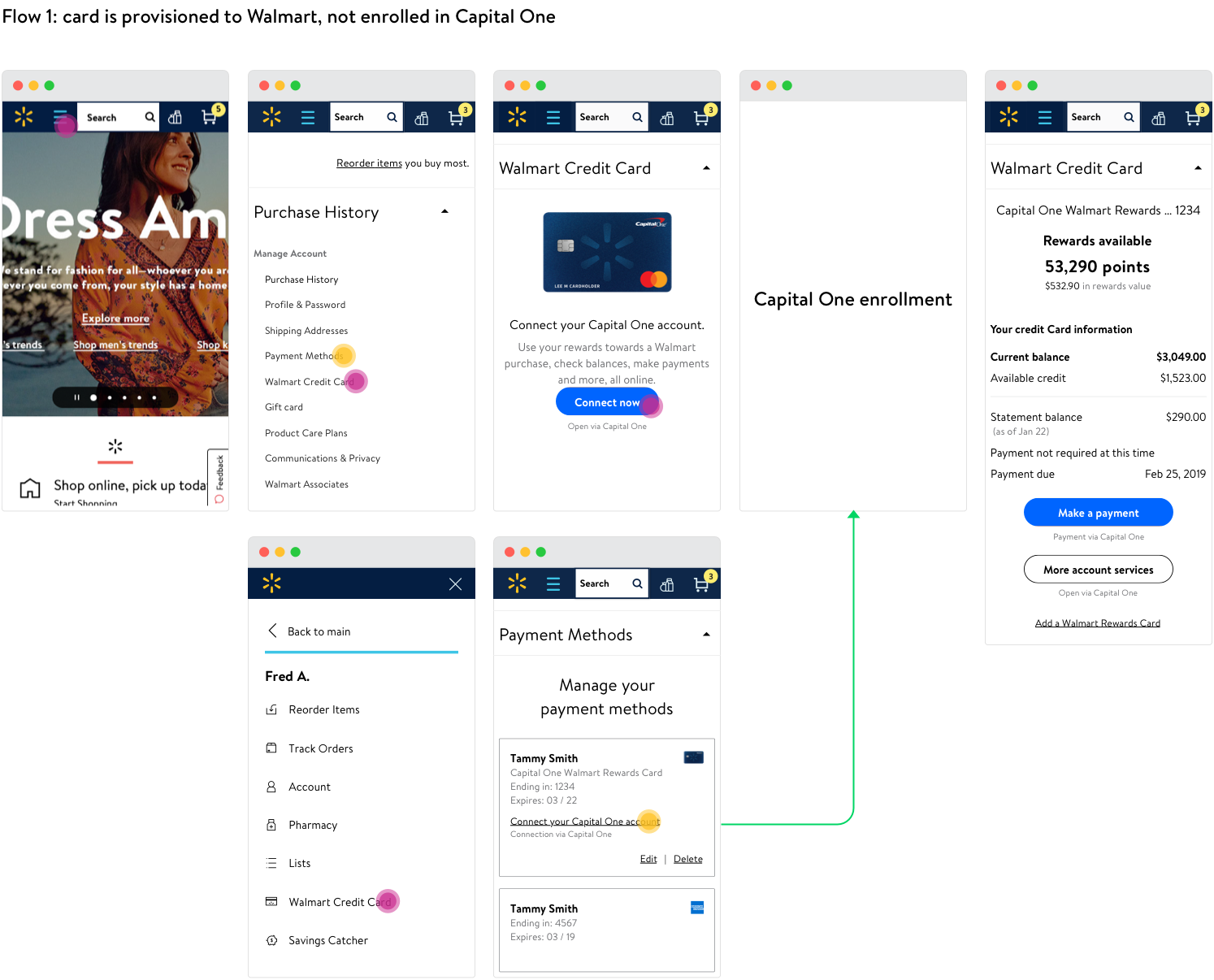

3. Servicing - Link COF account to enable richer servicing experience (credit limit, open-to-buy, balance, payment due date, rewards)

Launch Date

Sep, 2019

Capital One Walmart Rewards Card

Walmart and Capital One are on a similar mission to help customers save money and time in their retail and financial lives.

The new Walmart Credit Card rewards our customers for shopping at Walmart, and enables them to save money & time.

Our goals are not only to increase spend, but also to be 1st in wallet & increase digital engagement.

Product thinking - Why the card is great

What benefit can Cap One Walmart Rewards Card bring to both customer and Walmart?

For Customers

1. Customers Save More Everyday - More rewards earned when shopping in Walmart stores, Walmart.com / App, and outside Walmart with restaurants and travel.

2. Redeem Rewards 5 Different Ways - Provides more options & customer choice in redeeming rewards.

3. Helps Customers Discover Walmart’s Omni Tools - Provides compelling incentive for customers to discover Walmart’s suite of omni tools (e.g., Lists, Maps, Item Finder, Digital Receipts) to enrich their overall Walmart experience.

4. Looks Out for Customers - Looks out customers and their money with new, powerful digital tools from Capital One.

For Wamart

1. Enhances Walmart's Price Leadership - Increase competitiveness through price leadership to drive top line growth.

2. Strengthens Walmart's Omni Penetration - Creates an incentive gateway for Walmart to grow omni shoppers and increase value across touchpoints.

3. Unlocks Customer Data - Expands outside + inside spend data to build deeper, targeted relationships with customers.

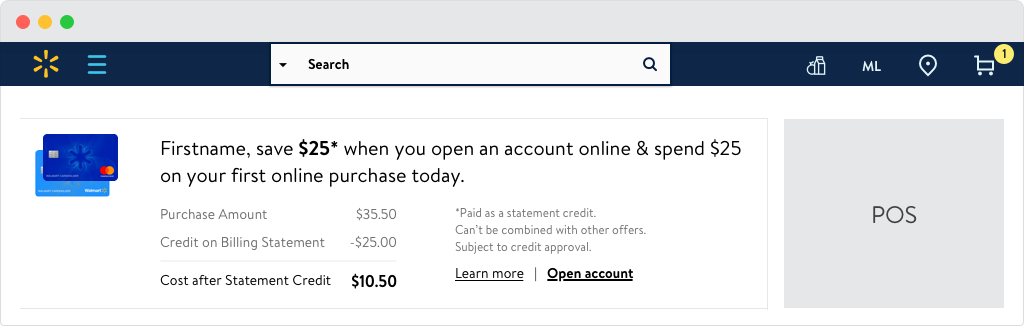

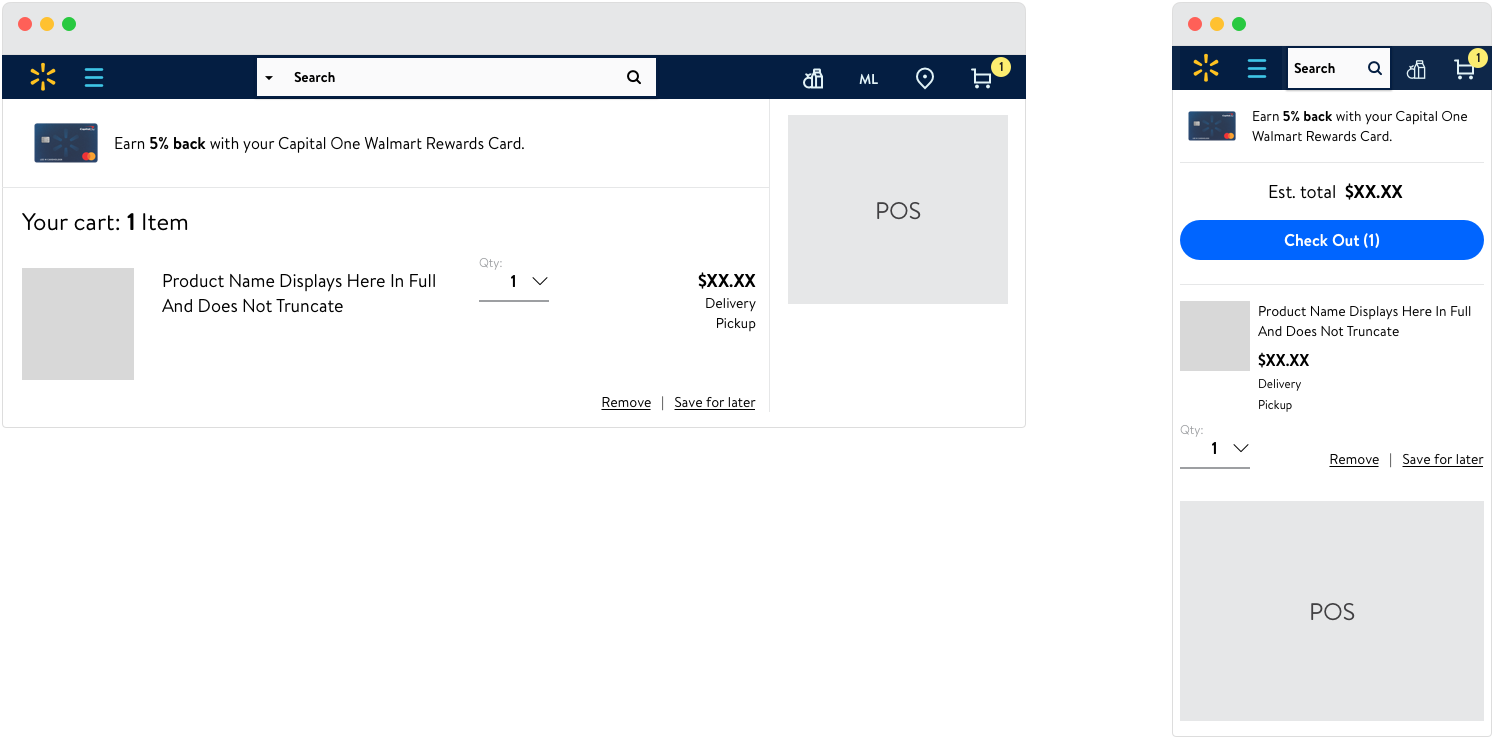

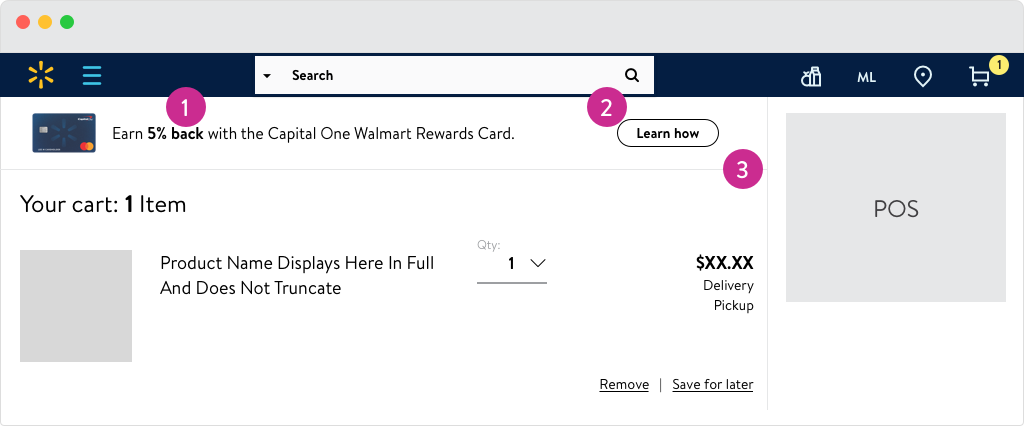

Entry point - Cart

Our overall goal is to not only to increase awareness and encourage quality applications, but to continue to engage with our customer throughout her journey to encourage card usage, management, and loyalty.

1. Drive awareness & engagement.

2. Increase approved applications.

3. Increase overall and repeat usage.

Cart has 34% visit rate and 77% new account rate based on our customer traffic.

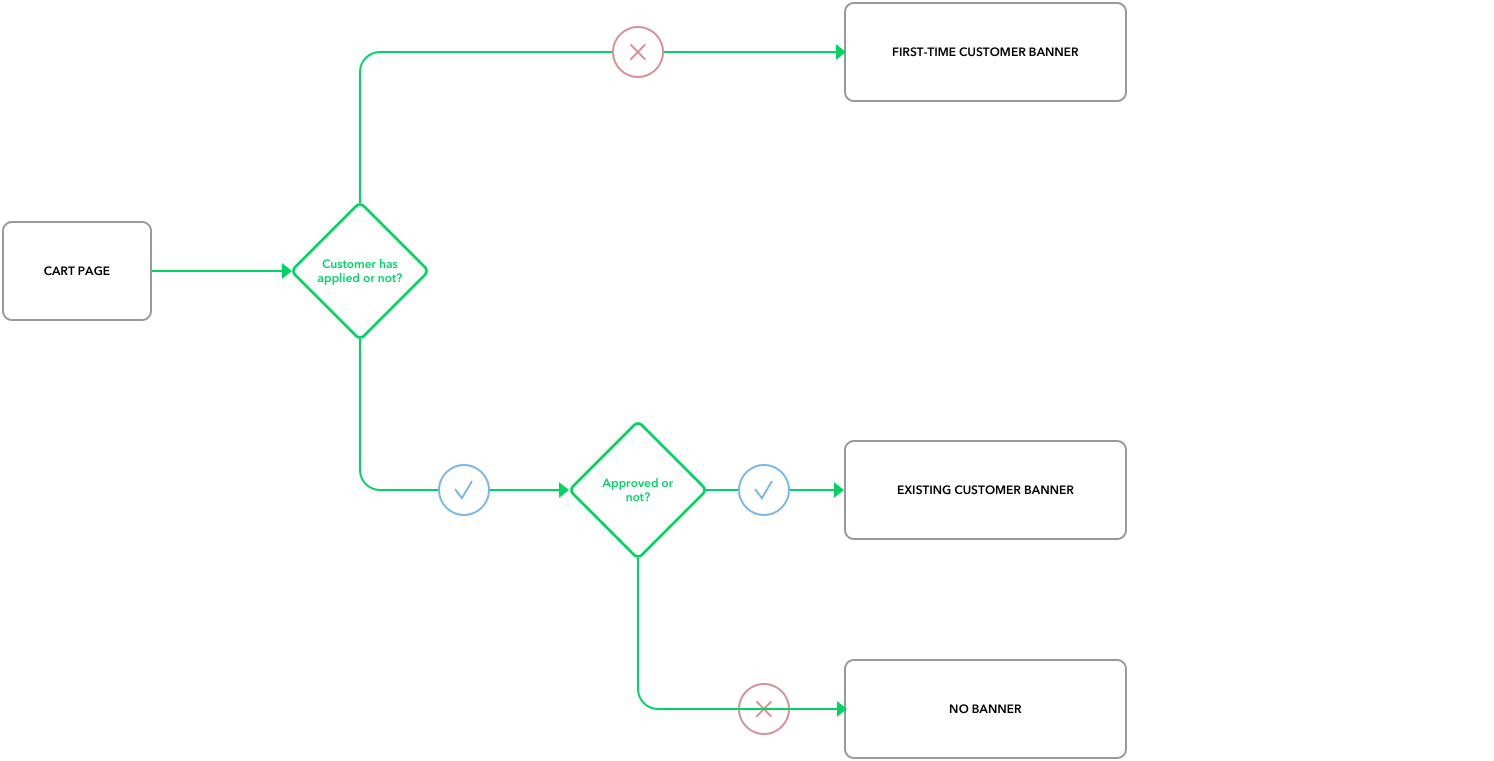

Approach

1. Mobile-first.

2. Focus on not only driving applications, but quality applications & digital engagement.

3. Contextual, personal messaging which is appropriate to the user, e.g.

a. First-time: Encourage application.

b. Existing: Encourage usage & digital engagement.

c. Decline customer: Avoid over-marketing.

1. Entry points are desktop-first.

2. Current marketing points are not contextual or personal to the customer (customers who already have the card or who were declined continued to see the generic promo).

3. Messaging encourages application/1st time purchase, but not subsequent purchases/returning users.

User Flow

Customer does not have card

customer has card

What is the change?

1. Entry points are desktop-first.

2. Current marketing points are not contextual or personal to the customer (customers who already have the card or who were declined continued to see the generic promo).

3. Messaging encourages application/1st time purchase, but not subsequent purchases/returning users.

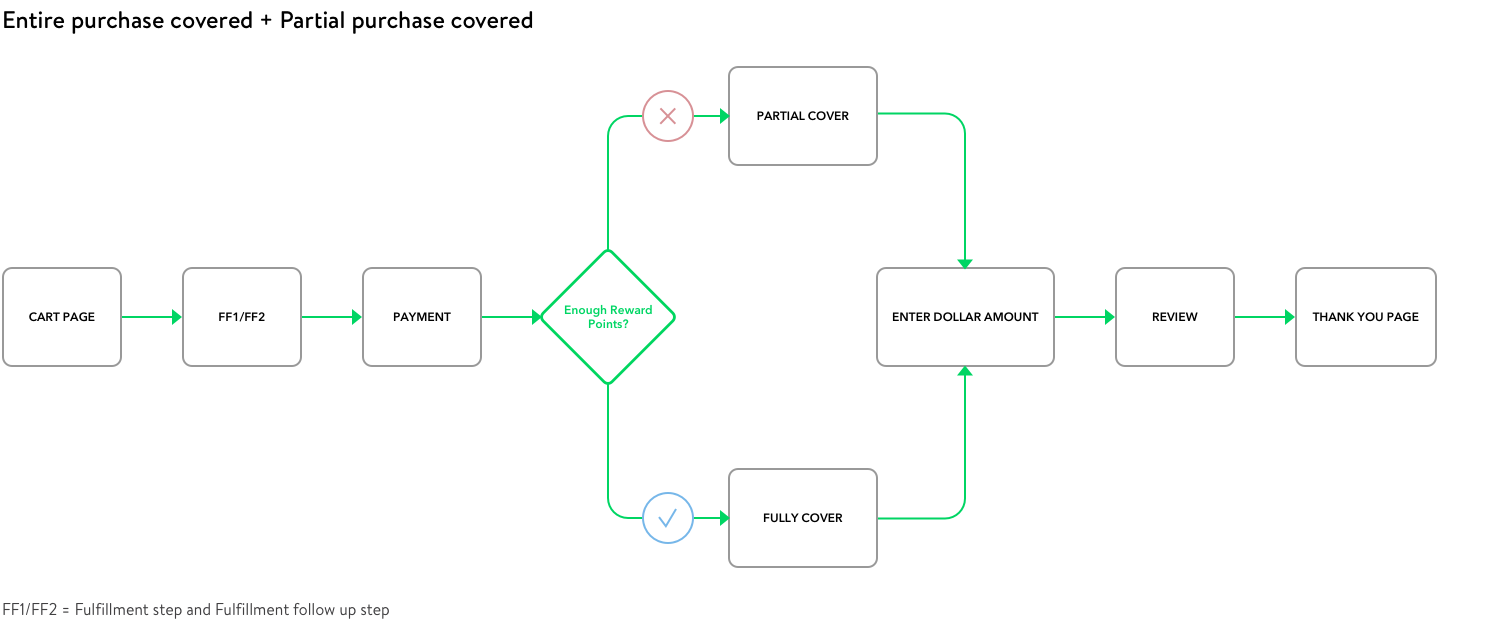

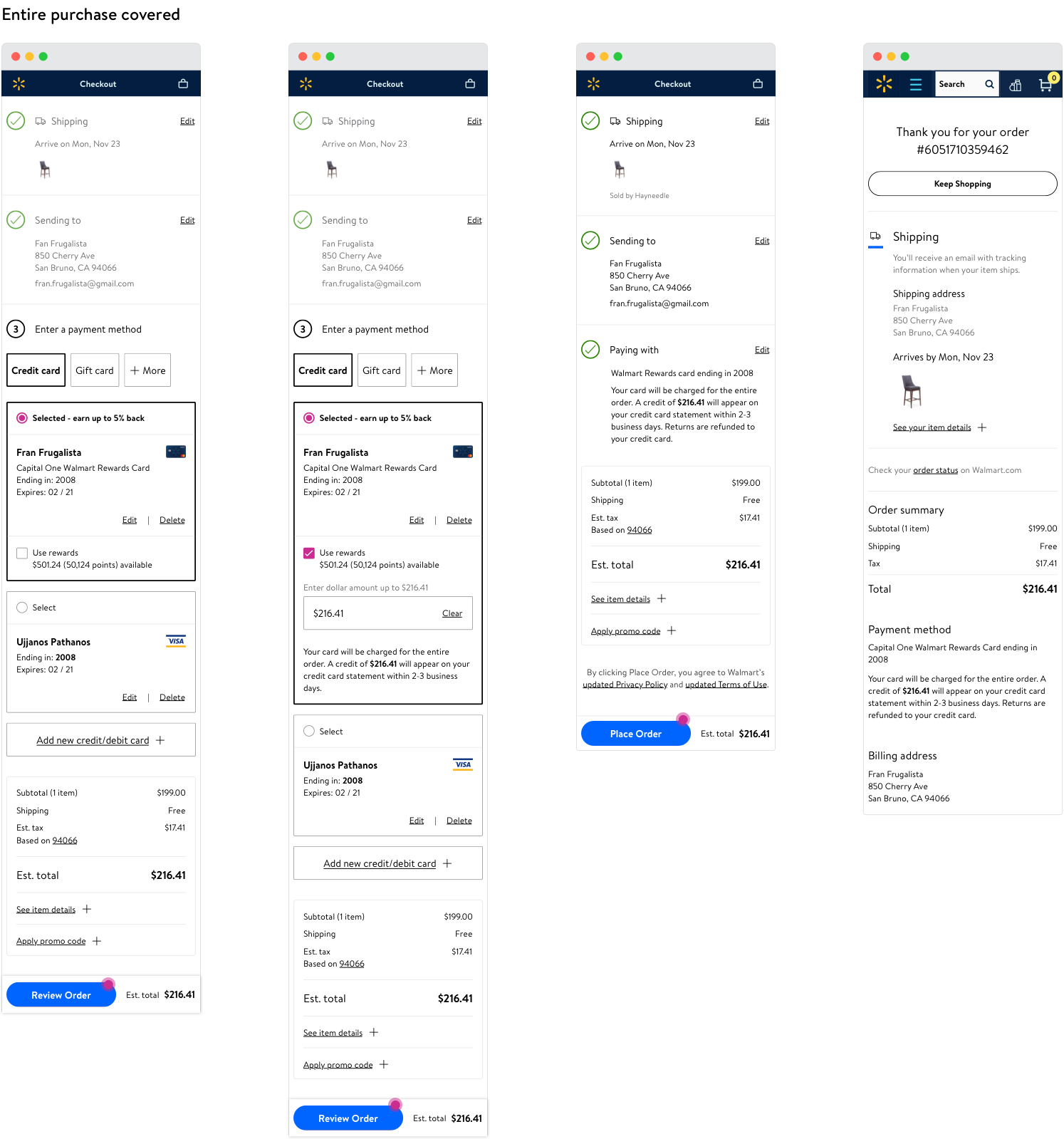

Pay with points

With new Capital One Walmart Rewards Card, we are introducing a new way for customer to redeem their rewards - by using their points to redeem Walmart.com purchase.

User flows

Use cases

servicing

Servicing allow customer to check their banking balance, reward points, make payment, etc without opening CaptialOne App, all these can be done on Walmart.com or Walmart App

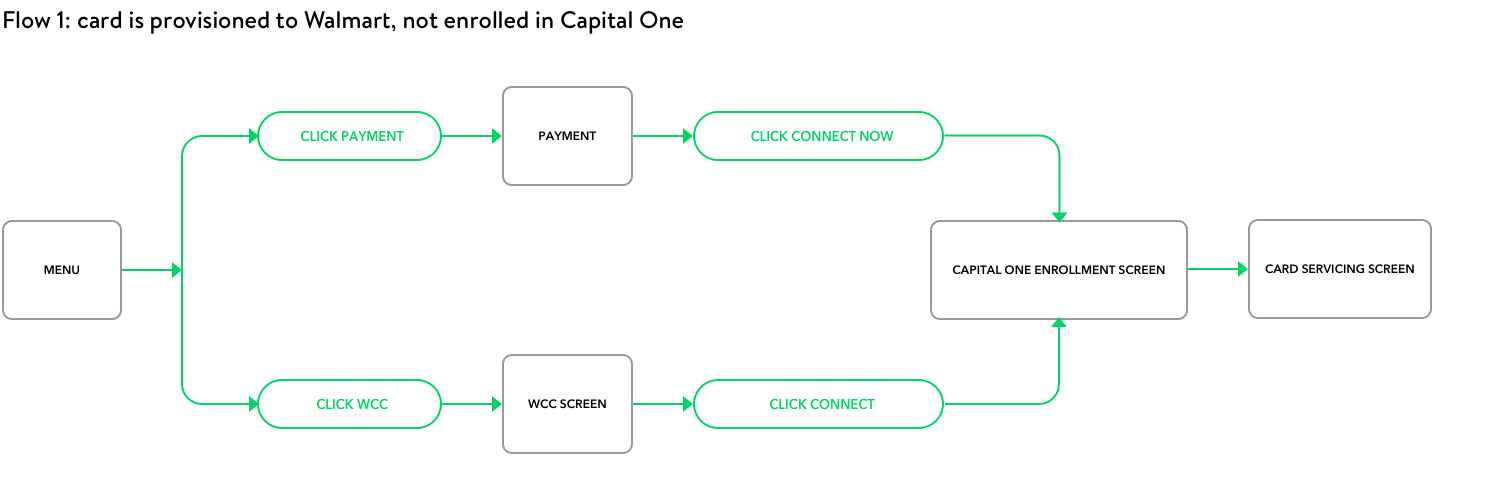

User flows

Use cases